A shorter version of this article was published by Supply Management in December 2014, and can be found here.

Taking the long view on environmental sustainability can seem somewhat remote from the day job of most people working on the front lines of procurement and supply chain. However, embedding this thinking into business strategy and management has never been more important to improving resilience and competitive advantage.

Resource and climate risks

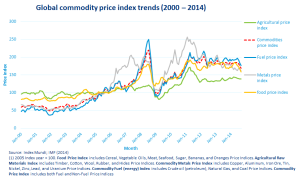

Labour productivity and cost has improved over the past decades thanks to ICT, mechanisation and moving production to low-cost countries. At the same time material and resource input costs have been trending in the opposite direction. Average global commodity prices have more than trebled since the year 2000 at their recent peak.

Figure 1 Global commodity price index trends (2000 – 2014)

Rising commodity prices have affected all categories, including agricultural, food, metals, and fuel commodities. Some areas have become particular pinch points, such as rare earth metals (vital for electronics, motors, and turbines). In 2014, the EU identified 20 critical materials as being at supply risk, up from 14 in 2010.

In fact, decreasing labour costs are no longer a buffer to energy and resource price volatility. In China, for instance, margins are being impacted by rising energy costs at each stage the value chain, while labour costs are now increasing. Some sectors such as textiles can easily shift to lower cost countries. However others, such as electronics and high tech, are dependent on specialised infrastructure as well as skilled labour and managers.

The supply and demand dynamics behind these trends are likely to continue exerting pressure over the next 5-10 years and beyond. One important driver is demographics. While the world’s population will add a further billion by 2030, it is the growth of the global middle class, and associated consumption patterns, which will sustain demand for energy and resources. The expected rate of wealth creation will be unprecedented: an extra 2.5 billion people will become middle class consumers over the next 10-15 years.

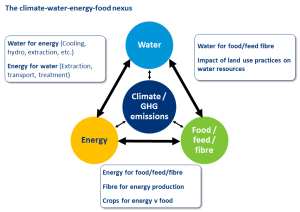

The impact of climate change, and the interrelationship between energy, water, and food, will exacerbate risks. The latest assessment of the Intergovernmental Panel on Climate Change (IPCC) highlights that by 2030 many regions will be at substantial risk of climate impacts, which will result in supply chain disruptions. These include coastal and inland flooding, droughts, severe weather, and changes to ocean ecosystems.

Figure 2 The climate-energy-water-food nexus

Collaborating with the supply chain

Improving supply chain resource efficiency and resilience should be a natural fit within the role of procurement and supply chain management. However it can be challenging to reconcile longer-term issues with the commercial realities and short-term priorities of sourcing.

Developing a framework for collaboration outside the cut-and-thrust of sourcing and procurement processes can be a powerful mechanism for uncovering knowledge and innovation within the supply chain. As the interface with suppliers, Procurement can help frame and implement collaboration and open innovation initiatives. Given the importance of engagement and the commercial relationship, category managers and buyers need to be front-and-centre in this process. The Sustainability function can provide valuable support and linkages with other teams.

Significant opportunities are being demonstrated by the likes of M&S, Tesco and a number of manufacturing multinationals. This includes collaborative buying, process innovation, and supply chain optimisation. Looking at energy as an example, we have found that up to 40% cost savings are achievable within Tier 1 suppliers. These can be addressed in a ‘win-win’ manner with the right mechanisms and incentives.

Supply chain resource and risk mapping can provide the intelligence for product design and production strategies that hedge commodity price volatility. Using this intelligence in product design can enable companies to optimise the use of raw materials, or substitute them entirely, while creating even better customer propositions. For example in BT, teams use a Design Checklist tool to build resource efficiency into products from the start of their development cycle.

Figure 3 Procurement and supply chain as a key interface for value chain innovation

Building better business models

Procurement and supply chain can help shape innovative customer value propositions and ensure the business model as a whole becomes more resource efficient. Companies that have taken a long view on sustainability, and integrating this into their business model, are already demonstrating the benefits.

Caterpillar, Phillips and Desso have all become great case studies showing how creating more ‘circular’ value chains improves margins, revenues and security of supply. They are doing so by taking back parts and products at end-of-life, remanufacturing or reprocessing them, and reselling them to the same or different customer segments. This is usually embedded within an end-to-end service proposition.

Fully closed-loop recycling, where materials are reclaimed and recycled back into new products, is now close to becoming a reality at a meaningful scale. New materials, technologies, processes and supply chain partners are enabling these types of models to emerge and gain traction. This is expanding and redefining the remit of supply chain and procurement. Some of the most exciting opportunities in the UK are in remanufacturing, where a market potential of up to £5.6 billion has been identified.

Making the transition work

The first step towards making a change is to understand the business case. Quantified risk and opportunity scenarios can be developed by drawing on supply chain and market insights. Generating ideas for alternative business models in cross-functional teams also reveals opportunities for prototyping and testing.

Strategic decisions can then be taken regarding how to engage with suppliers in the implementation phase. Where common sector-wide challenges are found, pre-competitive collaboration with industry peers is a valuable approach. Setting ambitious targets also serves as a useful reference point in framing a strategy, and provides the impetus needed to potentially re-think a business model and deliver transformative change.

Workstreams addressing specific areas of risk and opportunity can then be developed. These should ideally be phased to establish a strong basis for change: engaging internal and external stakeholders; piloting new processes and models; learning from successes and failures; and rolling out what works.

Figure 4 Embedding sustainability within the supply chain and business model