Over the past decade, the business agenda on climate change for UK companies has evolved from an initial focus on regulatory compliance, then to a realisation of the benefits for cost reduction through energy efficiency. More recently, leading organisations have incorporated carbon and climate change into wider cost and risk management considerations, such as supply chain transparency and procurement policies. Companies are now also integrating energy, carbon, and wider resource efficiency into their products and services, thereby tapping into growth opportunities.

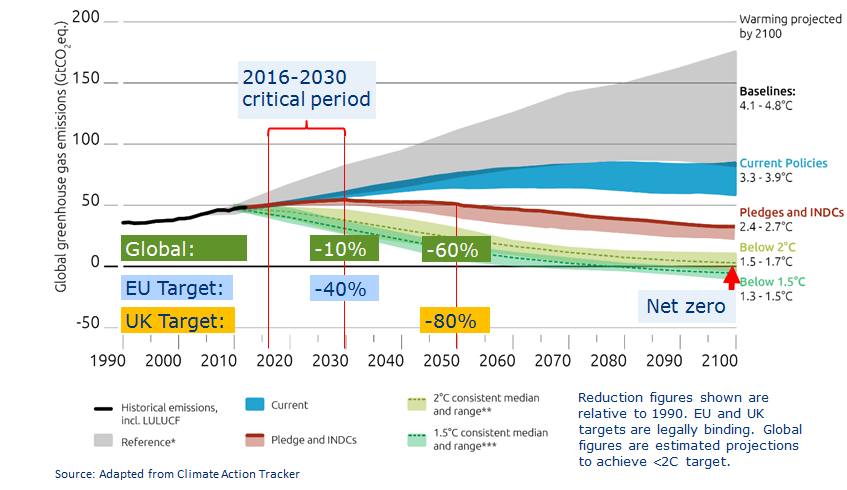

One of the drivers of this evolution is that climate change and carbon-related risks and opportunities are coming into the planning horizon of company boards, as well as that of their investors and stakeholders. The COP 21 Paris Agreement is an important milestone: With countries agreeing to hold global warming well below 2°C and pursue efforts to limit the increase to 1.5°C, a clear message has been sent that the world is committed to transitioning towards zero-carbon.

To fulfil this commitment, global emissions need to reach ‘net-zero’ by 2100, and at least peak – if not start decreasing – within the next 15 years. The period between now and 2030 will therefore be critical as it will determine whether the world can successfully shift onto the required trajectory. This means reducing global carbon emissions by about 40% from present levels (or approximately 10% below 1990 levels) by 2030 despite energy demand being forecast to rise by 25% as economies grow and develop.

Figure 1 Global greenhouse gas emission pathways

The low carbon transition creates challenges and opportunities for business

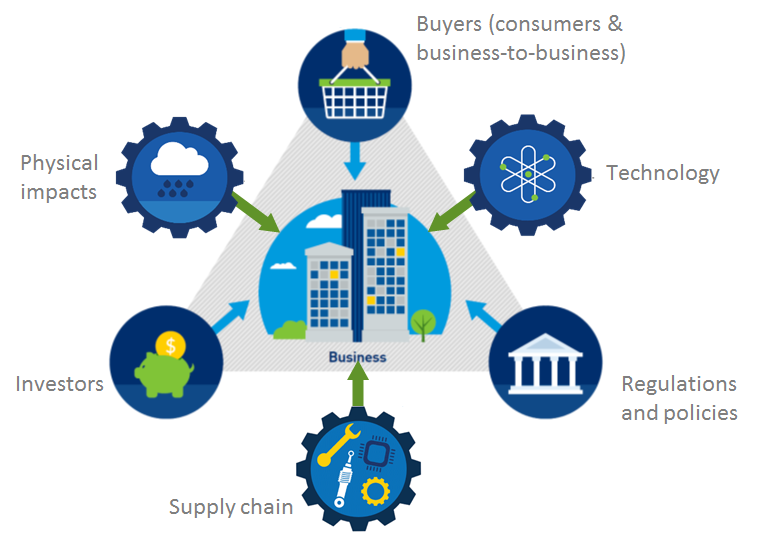

This transition will create challenges and opportunities for business. The strength, nature, and timing of these impacts will differ between geographies and sectors. However all large companies – in particular global corporates – need to address these.

Figure 2 Climate risk and opportunity drivers for business

Physical impacts of climate change. The increasing severity and frequency of weather events (including storms and droughts) as well as shifting climate patterns, will impact companies. Agricultural supply chains will be particularly vulnerable.

Regulations and policies. Changes to regulations and polices can create winners and losers, depending on companies’ abilities to transition towards lower carbon business models. These may either have direct impacts, or work indirectly by shifting the market and customer preferences – for example incentivising adoption higher efficiency products and lower-carbon technologies.

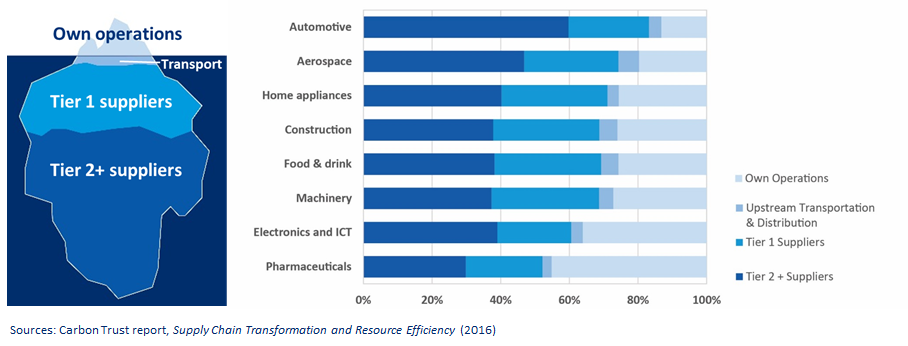

Supply chain. Carbon emissions and related energy consumption within a company’s supply chain often dwarfs that of the same company’s operations, as illustrated in Figure 3. This provides an example of how supply chains can be a magnifier of climate and resource risks: the risk drivers discussed above (regulatory, climate) as well as energy price volatility can be passed through the supply chain and impact companies’ profits.

Figure 3 Supply chain carbon emissions relative to carbon footprint of own operations

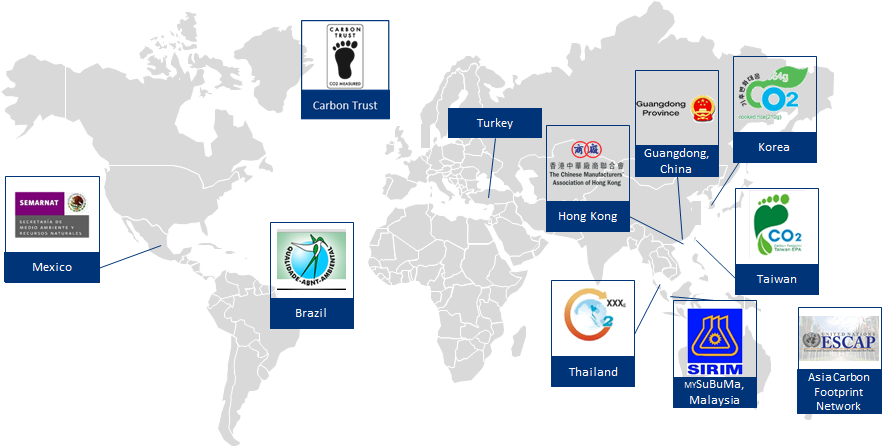

Buyers (in particular business-to-business). Customers are demanding increasing transparency of carbon within their supply chains. Almost 10 years ago, the Carbon Trust created the world’s first product carbon footprint standard and label to enable companies to communicate the carbon footprint of products and services. Over the last three years, the Carbon Trust has been developing and aligning similar schemes around the world to a common set of methodologies so as to facilitate inter-operability. An important driver is the desire to certify the carbon footprint of products to meet information and performance requirements of business customers in both export and domestic markets.

Figure 4 International alignment of product carbon footprint certification schemes

Investors. Investors are also increasingly seeking transparency of climate change-related risks within their portfolios, as well as wanting to understand the positive impact of investment. Mark Carney of the Bank of England and Michael Bloomberg have been leading voices in climate-related financial disclosure. They jointly head the Task Force on Climate-related Financial Disclosures (TCFD), which has the purpose of developing voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers, and other stakeholders.

Corporate action and leadership on Climate Change

Business has the opportunity to be part of the solution for climate change. This means being proactive – anticipating and taking appropriate action. The challenge is that companies often see little benefit, and often risk, in doing so. It is therefore useful to demonstrate key strategies and approaches leading companies are taking to tackle climate change.

Aligning corporate carbon targets with the science

Many organisations have set short or medium-term carbon targets (with 5-10 year timeframes). However these are usually not connected to decarbonisation pathways required to keep global temperature increase below 2°C. In contrast, a carbon target is defined as ‘science-based’ if it is aligned with this ambition and the climate science supporting it.

The Science Basted Targets initiative provides a framework and methodology through which companies can define and commit to decarbonisation pathways appropriate to their organisation. With over 170 signatories, these include global companies in consumer goods (such as Unilever, P&G, Nestlé, Coca-Cola) financial services (HSBC, AXA), utilities, and manufacturing, among others.

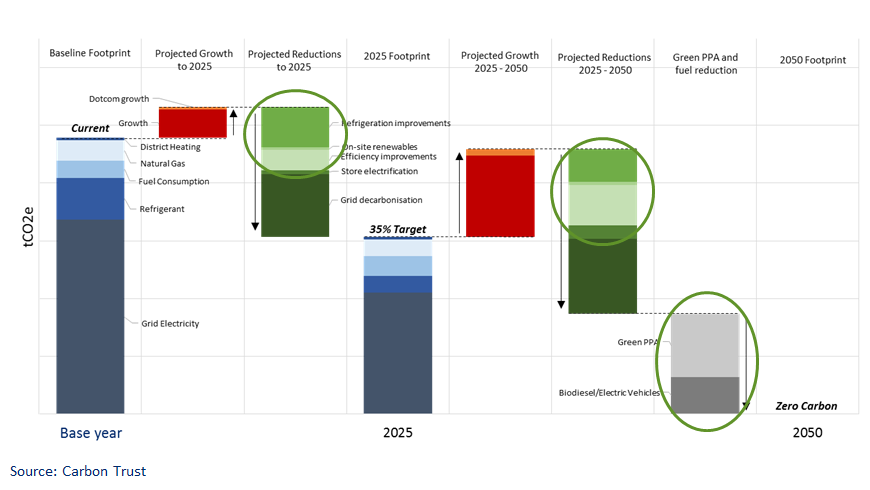

Sophisticated carbon target-setting requires a ‘bottom up’ assessment of carbon reduction opportunities, taking into account baseline changes in carbon emissions due to company growth. Figure 5 below shows an example approach, where energy efficiency opportunities as well as renewable energy and ‘green electricity’ purchasing are all considered.

Figure 5 Illustration of a zero-carbon strategy

Another initiative that supports the setting of science-based targets is the ‘100% Renewable Energy’ (or RE100), where participants commit to source 100% of their energy from renewables. Businesses taking part include BT Group, Mars, Unilever, Procter & Gamble, IKEA Group and Nike. This move has been strengthened by changes to corporate reporting under the Greenhouse Gas Protocol, allowing businesses to specifically recognise the purchase of clean energy in their carbon accounting.

‘Net Positive’ strategies

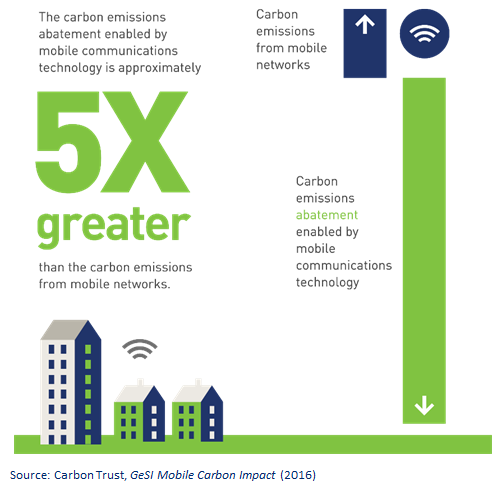

Where science-based targets are set for an organisation’s own boundaries, a commitment to ‘Net Positive’ involves a business giving back more than it takes. In terms of carbon, this can be framed as a company’s products and services ‘enabling’ the reduction of carbon by end-users in a way that is significantly larger than their own carbon footprint, thereby providing a ‘net’ positive impact.

This approach is a lot more ambitious than focusing only on one’s own footprint. Extending the strategy out to positively impact customers and the supply chain enables engagement with a wider stakeholder community and links the carbon agenda to business growth. Figure 6 below demonstrate the net positive (or enabling) impact of mobile communications technologies, quantified by the Carbon Trust in a recent report.

Figure 6 Enabling the abatement of carbon emissions through mobile technology

An example of a company using this approach is BT’s Net Good programme, launched in June 2013. Through this programme, BT aims to help its customers reduce carbon emissions by at least three times the end-to-end carbon impact of its own operations by 2020. At the same time, BT is targeting an 80% reduction in the carbon intensity of its global business per unit turnover by continuing to work on improving the sustainability of its own operations and extending the influence to its supply chain. BT’s focus on being a responsible and sustainable business leader has seen its operating costs reduce by 14% and EBITDA boosted by 6%.

Supply chain collaboration and innovation

To address the full range of risks and opportunities within supply chains, collaboration is needed between companies and their suppliers. This ranges from jointly investing in supply chain efficiency improvements, through to new material innovation for products. Collaboration initiatives are strengthened when they are supported by a company’s procurement function, as this can bring positive commercial incentives (e.g. purchasing commitments in return for supplier investment in innovation and performance improvement).

An example of a company that has invested significantly in supplier collaboration is global pharmaceutical giant GSK. The company spends over £2bn annually on materials, which drives over 40% of its value chain carbon footprint. GSK’s long term goal is to be carbon neutral across its value chain by 2050. In looking at energy and carbon within its supply chain, GSK established that 65% of suppliers did not have an active programme in place to reduce energy costs. In order to drive engagement at scale, GSK set up an online exchange for suppliers to share best practice on energy efficiency and reducing environmental impacts. More than 500 suppliers have joined the network, which is expected to enable value chain emissions to be cut by 25% by 2020. In addition to the exchange, GSK has also run energy reduction workshops at supplier sites, identifying opportunities to save 20-30% of energy costs.

Embedding carbon within business strategy

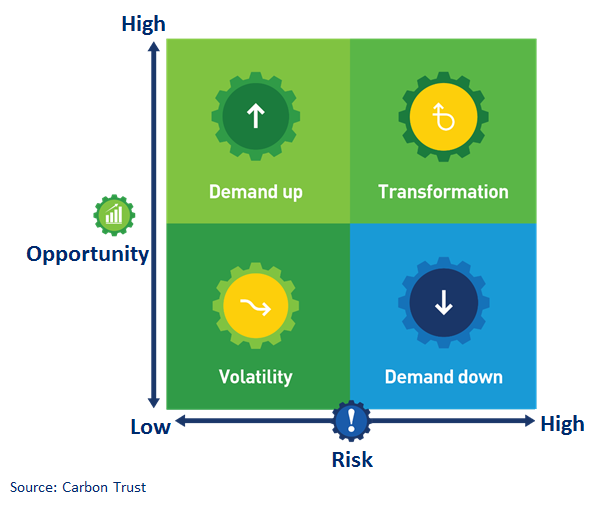

Few companies assess the foreseeable opportunities and risks from climate change and resource scarcity and their potential impacts. This can leave a business exposed to changes in regulation, shifts in demand, or technology breakthroughs. Nevertheless, company boards face competing priorities and are themselves under pressure to focus on the shorter-term business planning horizon. They also lack an approach, or a set of practical tools, for assessing and quantifying risks and opportunities from the transition to low/zero carbon.

In response, the Carbon Trust has developed methodologies to assess and quantify company value at stake, helping identify which options need to be developed now for potential deployment beyond the horizon of today’s business planning (illustrated in Figure 7 below). This approach includes understanding ‘business-as-usual’ conditions and drivers of risk and opportunity which can impact company revenues and costs. Using scenario analysis, companies can then assess impacts of different drivers on company value. This insight can be used to develop appropriate strategies such as: changes to business model, changes to products and services; investment in technology; etc.

Figure 7 Value at stake framework

Conclusions and perspectives for UK-Japan low carbon cooperation

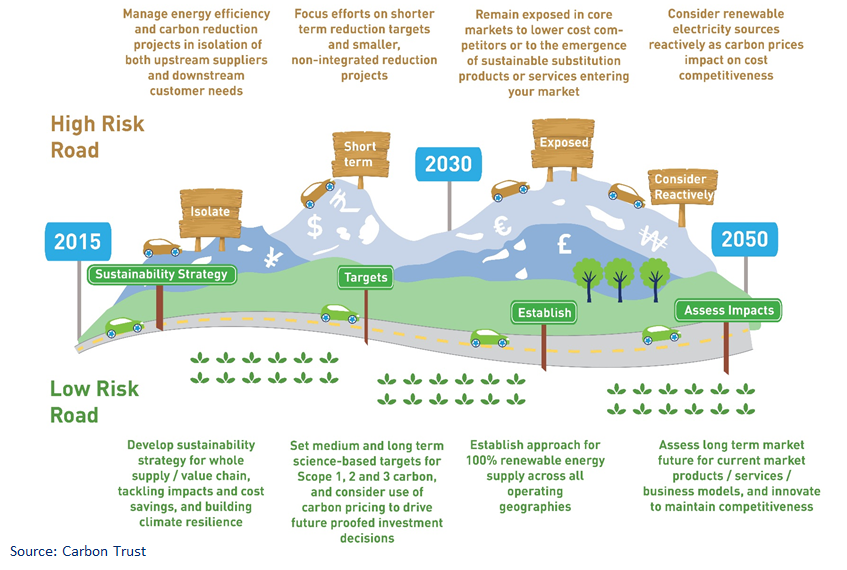

Businesses need to think seriously about how they will navigate the journey to a sustainable, low carbon economy. Change brings both opportunities and risks, so there are likely going to be losers as well as winners. Companies therefore need to develop roadmaps that provide a sensible way of achieving a low carbon transition. However the right strategy isn’t always obvious, and must be tailored to a company’s circumstances and broader business context.

What is clear is that business-as-usual, where no consideration or action is taken on climate change, is a high risk approach. This is especially true for global companies, among which Japanese corporates are no exception.

Figure 8 Corporate roadmaps for a transition to low carbon

This article is based on a talk I gave at the British Embassy in Tokyo in June 2016. A version in Japanese has been published by the Embassy which can be found here.